FX risks for Akzo Nobel 2022 Best

For this assignment we will explore FX risks for Akzo Nobel. Describe the mechanism of direct and indirect finances available to Akzo Nobel? Which one do you think will be preferred?

FX risks for Akzo Nobel

Instructions for assessment Akzo Nobel plans to open a new factory in the UK. The cost of building new factory is £100 million: 1. Describe the mechanism of direct and indirect finances available to Akzo Nobel? Which one do you think will be preferred? And why? [10 marks] 2. Describe the types of financial intermediaries that can help Akzo Nobel to finance new factory? Are there any differences in the way they can provide financing? [15 marks] 3. Which exchange does Akzo Nobel use to issue shares for raising capital? (examine Investor relations website https://www.akzonobel.com/en/for-investors/for-investors-overview). How big was capital raised? What is shares buyback, and what are the reasons behind a buyback?

FX risks for Akzo Nobel

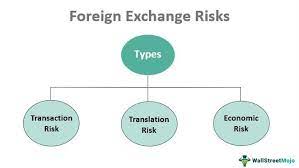

4. What is the price of Akzo Nobels 1.625% annual coupon bond with maturity on April 2030 and required rate 1%, face value 1000 EUR? Show your calculations. What is a range for ratings of existing Akzo Nobel bonds (AAA, Abb, etc)? Is there any collateral for the bonds? Should the company issue bonds or stocks (explain your reasons)? [20 marks] 5. Assuming Akzo Nobel borrows £100 mil on UK market for ten years in the form of bonds (floating coupon currently at 2%). How should Akzo Nobel manage interest rate risk? [15 marks] 6. UK branch of Akzo Nobel operates in pounds; however, company headquarters are in the Netherlands. What FX risks does the company face?

FX risks for Akzo Nobel

How should Akzo Nobel hedge their FX risk? [15 marks] Additional 10 marks will be allocated for presentation and use of appropriate references. How will your work be assessed? Your work will be assessed by a subject expert who will use either the marking criteria provided in the section “Instructions for assessment” or the Marking rubric enclosed in the Appendix, as appropriate for this module. When you access your marked work it is important that you reflect on the feedback so that you can use it to improve future assignments.

FX risks for Akzo Nobel

Marking and feedback process Between you handing in your work and then receiving your feedback and marks within 20 days, there are a number of quality assurance processes that we go through to ensure that students receive marks which reflects their work. A brief summary is provided below. · Step One – The module and marking team meet to agree standards, expectations and how feedback will be provided. · Step Two – A subject expert will mark your work using the criteria provided in the assessment brief.

FX risks for Akzo Nobel

Step Three – A moderation meeting takes place where all members of the teaching and marking team will review the marking of others to confirm whether they agree with the mark and feedback · Step Four – Work then goes to an external examiner who will review a sample of work to confirm that the marking between different staff is consistent and fair https://youtu.be/DGa7taCzOO0

Additional Files