Tag Archives: fiscal policy

Relation between unemployment and inflation. 2022 Best

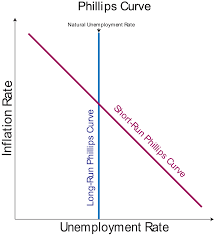

For this assignment we will evaluate the historical relation between unemployment and inflation. Distinguish between the short-run and the long-run in a macroeconomic analysis. Why is the relationship between unemployment and inflation different in the short-run and the long-run?

Relation between unemployment and inflation.

Unemployment and inflation are an economy’s two most important macroeconomic issues. The federal government’s fiscal policy and the Federal Reserve’s monetary policy try to maintain both a low unemployment rate around a natural rate and a low inflation rate around 2%. In your Final Paper, Evaluate the historical relationship between unemployment and inflation. (hint: You may start from A.W. Phillips’s finding of the relationship between unemployment and inflation.) Distinguish between the short-run and the long-run in a macroeconomic analysis. Why is the relationship between unemployment and inflation different in the short-run and the long-run? Assess the recent 20-year U.S. unemployment and inflation data.

Relation between unemployment and inflation.

Do the current U.S. unemployment and inflation data confirm the short-run Phillips curve? Analyze why the recent 20-year U.S. unemployment and inflation data approves or disproves the short-run Phillips curve. Evaluate whether the Phillips curve can still validly resolve today’s issue of unemployment and inflation and forecast unemployment and inflation. Why or why not? Recommend any policy, method, or opinions for the current U.S. unemployment and inflation as a policy maker for either fiscal policy or monetary policy (or both). The Short-Run and Long-Run Relationship Between Unemployment and Inflation Final Paper Must be eight to 10 double-spaced pages in length

Relation between unemployment and inflation.

Must include a separate title page with the following: Title of paper Student’s name Course name and number Instructor’s name Date submitted For further assistance with the formatting and the title page, refer to APA Formatting for Microsoft Word (Links to an external site.). Must utilize academic voice. See the Academic Voice (Links to an external site.) resource for additional guidance. Must include an introduction and conclusion paragraph. Your introduction paragraph needs to end with a clear thesis statement that indicates the purpose of your paper. For assistance on writing Introductions & Conclusions (Links to an external site.) as well as Writing a Thesis Statement (Links to an external site.), refer to the Writing Center resources.

Relation between unemployment and inflation.

Must use at least five scholarly, peer-reviewed, and other credible sources in addition to the course text. The Scholarly, Peer-Reviewed, and Other Credible Sources (Links to an external site.) table offers additional guidance on appropriate source types. If you have questions about whether a specific source is appropriate for this assignment, please contact your instructor. Your instructor has the final say about the appropriateness of a specific source for a particular assignment. Must document any information used from sources in APA style as outlined in the Writing Center’s Citing Within Your Paper (Links to an external site.) guide. https://youtu.be/GitxEGsEkCU

Additional Files

Multipliers in Oil Economies – 2022 Best

Report on state dependent Government Spending Multipliers in Oil Economies: Evidence from Iran. Most of the empirical VAR literature on the macroeconomics of fiscal policy does not distinguish between different types of government spending and treats total government spending as a single fiscal instrument.

Multipliers in Oil Economies.

This assignment is about a referee report.. .. Firstly, referee report should include Summary (overview-general impression) + major comments+ specific/minor comments. Secondly, this paper that I want to referee (State-dependent Government Spending Multipliers in Oil Economies: Evidence from Iran). Thirdly, most of the empirical VAR literature on the macroeconomics of fiscal policy does not distinguish between different types of government spending and treats total government spending as a single fiscal instrument. Fourthly, most of the literature interprets the empirical effects of this total government spending instrument as if they were the result of changes in government consumption of goods and services.

Multipliers in Oil Economies

However, government spending is not only consumption of goods and services. Government spending has tow parts: government investment and government consumption. I will restrict attention to government investment. Most of the literature looks at the aggregate effects, only a few papers investigates the sectoral effects of a rise in government imacroeconomics nvestment. Government investments affect different aspects of the economy, more particularly on traded and non-traded sector.

Multipliers in Oil Economies

The objective of my thesis is to identify the exogenous shock to government investment.. By collecting some data on time series of government investment for OECD countries. It aim to make a distinction between a traded and a non-traded sector.. To explore empirically the effects of a shock to government investment and to identify which sector (trade or non traded) will benefit from the rise in government investment. https://youtu.be/k0lZiahhXFs